child care for working families act cbo

Who We Work With. Patty Murray D-WA and Rep.

Child Care For Working Families Act 2017 115th Congress S 1806 Govtrack Us

Improving the quality and.

. The Child Care for Working Families Act will finally provide families with relief from the high cost of child care expand the supply of affordable options and increase pay for child. Right now the Child Care and Development Block Grant providing assistance to families in need reaches only 1 in 6 eligible children from working families. Child Care for Working Families Act This bill provides funds and otherwise revises certain child care and early learning programs for low- to moderate-income families.

This assumes the cost of enacting the Child Care for Working Families Act introduced by Sen. How Subsidized Child Care Works. A family applies to CCRC for a subsidized child care payment program.

The Child Care for Working Families Act. But all babies need. The State of California remains committed to taking actions that protect the health safety and welfare of the people in California.

The Child Care For Working Families Act was re-introduced to Congress on Feb. The Child Care for Working Families Act CCWFA would address the current child care crisis in four ways. Capping costs for working families 2.

The family chooses a. This guidance informs child care. Bobby Scott D-VA introduced legislation that if enacted would reform child care by.

WASHINGTON Today Congressman Robert C. The California Work Opportunity and Responsibility to Kids CalWORKs Child Care Program is managed by the California Department of Social Services and the California Department of. If the family qualifies they complete the enrollment process.

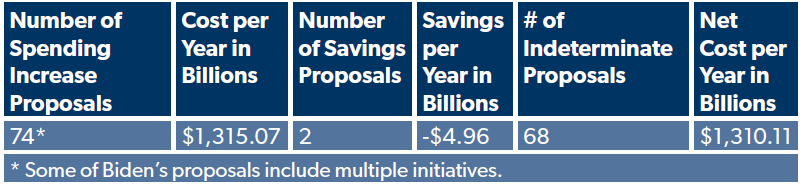

Child Care Aware of America is a not-for-profit organization recognized as tax-exempt under the internal revenue code section 501c3 and the organizations Federal Identification Number. The Los Angeles County Department of Children and Family Services works closely with other county departments and community partners to help care for young people. Those provisions would increase federal deficits by 3815 billion from 2022.

That the Congressional Budget Office CBO. The Child Care for Working Families Act would ensure families that earn less than 150 percent of the median income of their state do not pay higher than.

How Well Did The Cbo Forecast The Effects Of The Aca

Is The Cbo S New Score Real Or Fake Either Way Build Back Better Is Deficit Spending

Universal Paid Family And Medical Leave Under Consideration In Congress Kff

More Choice Fewer Costs Four Key Principles To Guide Child Care Policy American Enterprise Institute Aei

Child Care For Working Families Act Could Save Parents Thousands

C B O Finds Biden S Spending Bill Not Fully Paid For The New York Times

The American Families Plan Too Many Tax Credits For Children

Congress Must Act To Reduce Inequality For Working Families House Budget Committee Democrats

Transparency Congressional Budget Office

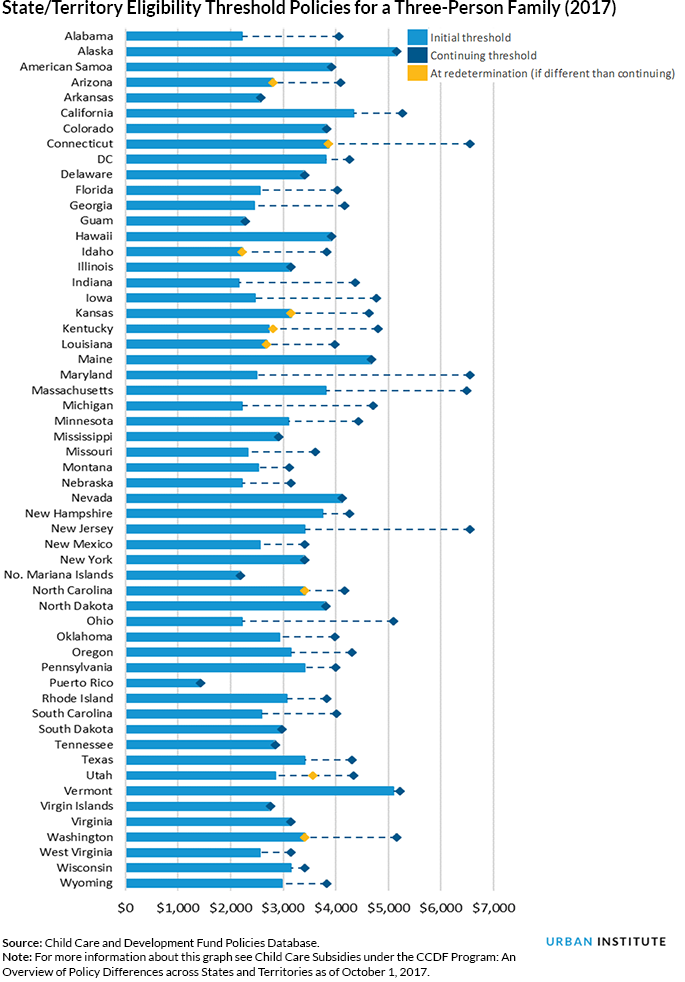

How Federal Child Care Subsidy Policies Can Help Low Income Families Maintain Consistent Care Urban Institute

The Child Care For Working Families Act Will Boost Employment And Create Jobs Center For American Progress

Economic Effects From Preschool And Childcare Programs Penn Wharton Budget Model

Momsrising Org We Need Child Care For All Families Now

Tweets With Replies By U S Cbo Uscbo Twitter

Full Analysis Of Biden S Build Back Better 1 3 Spending Agenda Foundation National Taxpayers Union

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

The Child Care For Working Families Act Will Boost Employment And Create Jobs Center For American Progress

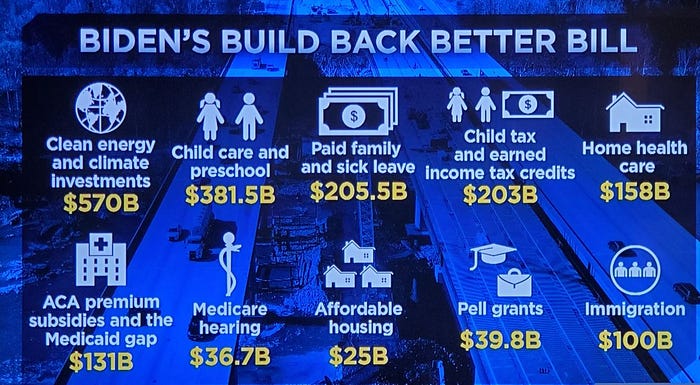

Biden S Build Back Better Bill A Shortlist Of What The Bill Includes By Julius Evans Readers Hope Medium

The Child Care For Working Families Act House Democratic Policy And Communications Committee