coinbase vs coinbase pro taxes

Previously Rickie worked as a personal finance writer at SmartAsset focusing on retirement investing taxes and. It is shown in the table below.

Crypto And U S Income Taxes When And How Is Crypto Taxed As Income Coinbase

Automate your strategy and relax.

. The biggest difference between Coinbase and Coinbase Pro is the fee structure. So I am finally wrapping up my 2019 taxes with all my new found free time and running into issues with profitloss using NicehashCoinbase. On Coinbase I bought ETH to hold.

USDC is fast secure and easy to send globally. I was looking for. Customers with these cases can use our crypto tax partner CoinTracker to aggregate their transactions across Coinbase and other exchanges wallets and DeFi services.

Ad Spend Your Time Trading Not Wondering What it Costs. Coinbase the platform a beginner-friendly crypto app and Coinbase Pro a full. Coinbase Tax Resource Center.

USDC is fast secure and easy to send globally. On Coinbase Pro I didnt to anything yet. These Coinbase pro trading fees start at 060 and fall as the monthly trading volume of more significant volume dealers increases.

Coinbase Pro on the other hand uses the maker-taker approach. Coinbase Pros user interface. The Coinbase fee structure is a tad bit complicated and a little more expensive than that of Coinbase Pro.

Find Coinbase Pro in the list of supported exchanges and select the import method you prefer. Coinbase offers a clean simple way to buy and sell cryptocurrency with only a few options for placing orders. It charges a higher amount for either a flat rate or variable fee based on the payment method.

Here is how it. I have had my coinbase account since 2016 never any issue using it except for the occasional re-verification of my identity ever year or so. Ad The Circle Account is the premier source of USDC liquidity built on blockchain technology.

Within CoinLedger click the Add Account button on the top left. Coinbase Pro costs less and uses a maker-taker approach with more or higher dollar. The two exchanges Coinbase and Coinbase Pro have different fees for registering transactions and depositing or withdrawing money to the exchange for users.

Coinbase Pro provides a. Ad The Circle Account is the premier source of USDC liquidity built on blockchain technology. Coinbase Pro on the other hand gives users advanced charting and.

Coinbase charges a fee of 099 to 299 per trade depending on the size plus a spread of about 050 between buying and selling prices. On Coinbase Pro you only pay the. Ad Spend Your Time Trading Not Wondering What it Costs.

I bought and sold 40000 in crypto last year on. There are several capabilities that set Coinbase Pro apart from Coinbase including. Ad Manage your portfolio across more than 18 exchanges in one easy-to-use interface.

I deposited 1000 but didnt buy anything yet. Coinbase Pro is cheaper and fees differ based on the amount of the transaction. In order to pay 15 tax I plan to hold them for at least 1 year.

Coinbase exchange charges a higher. The fees charged by Coinbase in the United States vary based on the mode of payment. The name Coinbase is often used as a catch-all for all of the offerings of Coinbase the company.

Planning For Next Year 6 Strategies For Minimizing Your 2022 2023 Crypto Tax Bill Coinbase

How Are Nfts Taxed A Guide For Creators Collectors And Investors Coinbase

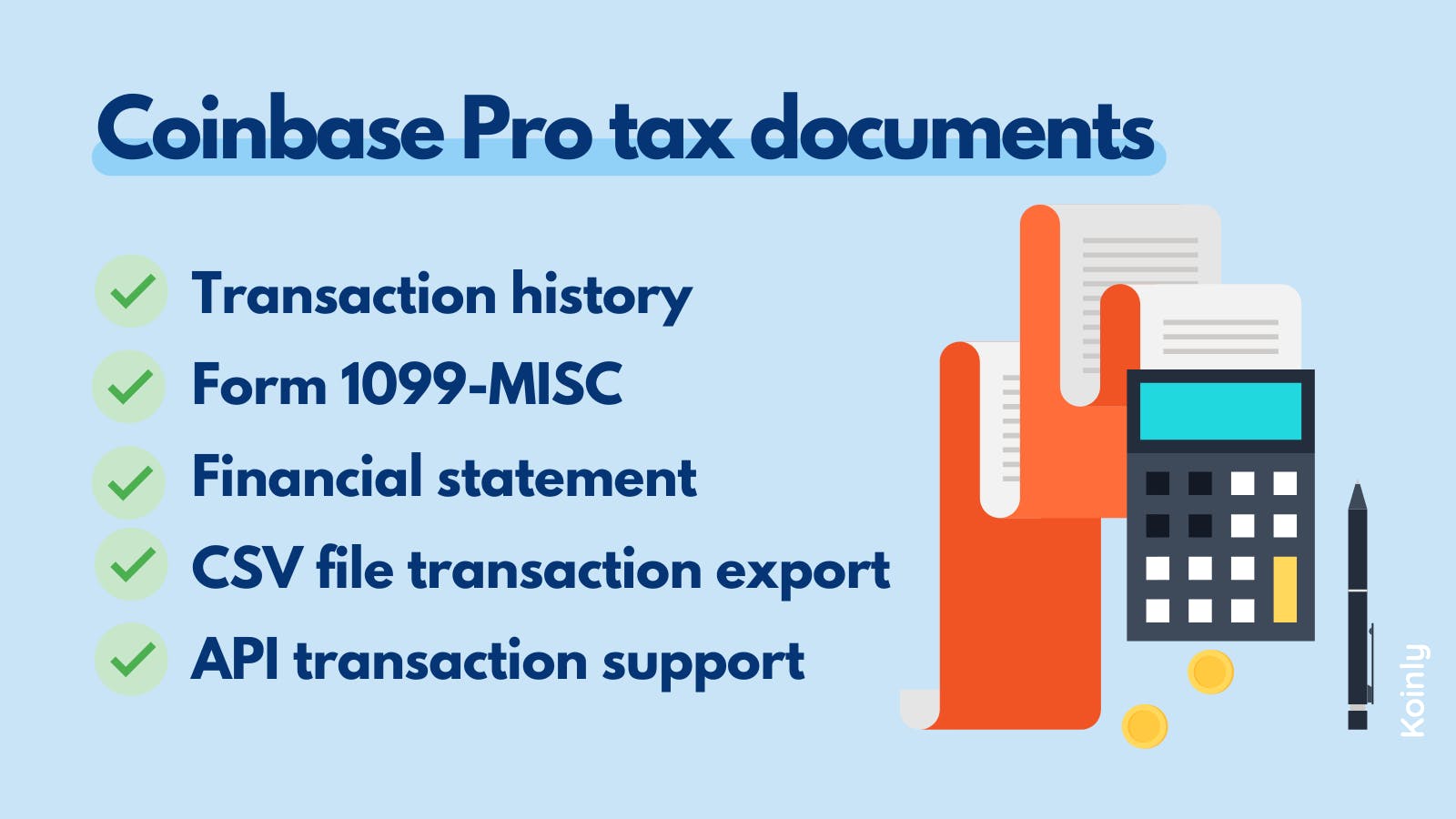

The Ultimate Coinbase Pro Taxes Guide Koinly

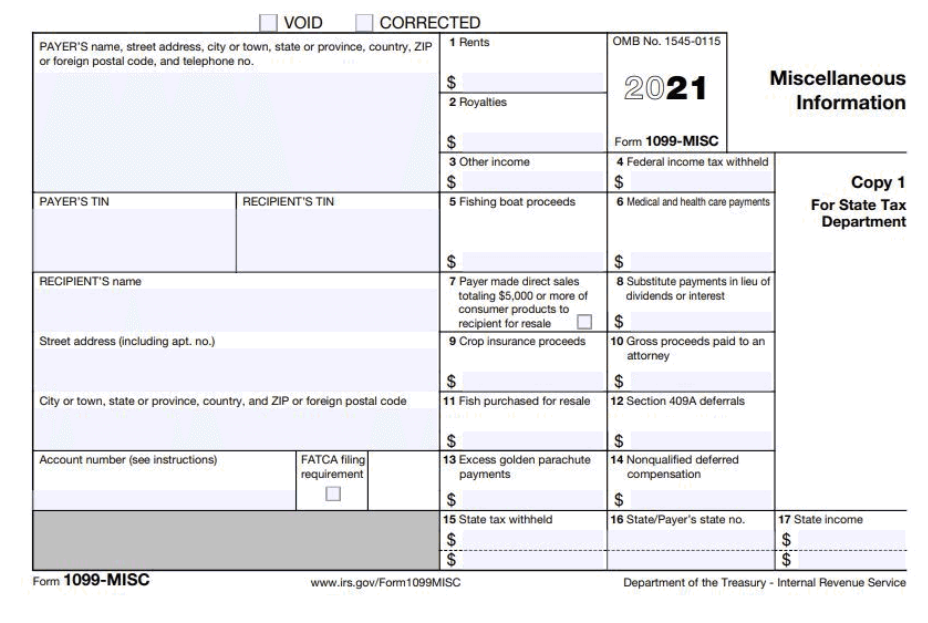

Coinbase 1099 What To Do With Your Coinbase Tax Documents Lexology

![]()

Using Turbotax Or Cointracker To Report On Cryptocurrency Coinbase Help

2021 2022 Crypto Tax Glossary Coinbase

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

The Ultimate Coinbase Pro Taxes Guide Koinly

Taxes Reports And Financial Services Coinbase Help

Coinbase 1099 Guide To Coinbase Tax Documents Gordon Law Group

Influencers Estimate Your Taxes In 3 Simple Steps And More Pro Tips To Start Or Grow Your Social Influencer Busines Bitcoin Value Tax Season Social Influence

Capital Gains Tax What Is It And How It Applies To Your Crypto Coinbase

Understanding Crypto Taxes Coinbase

The Ultimate Coinbase Pro Taxes Guide Koinly

Coinbase Is Committed To Helping Our Customers During Tax Season By Coinbase The Coinbase Blog

Does Coinbase Report To The Irs Zenledger

The Final Wazirx Review For 2022 In 2022 Cryptocurrency Spending App Networking

Cost Basis What Is It And How It Can Help You Calculate Your Crypto Taxes Coinbase